What Are Carbon Credits? The Crypto of Climate Change

If you plan to attend any energy or climate conferences this year, you’ll hear a lot of buzz about carbon credits—some good, some bad. If you listen closely, you’ll understand that most people talking about carbon credits have more opinions than facts.

In a world faced with fighting the impacts of climate change, carbon credits are the new cryptocurrency: they are relatively new, ubiquitously exciting, difficult to explain, and constantly changing. So, let’s take a look at what carbon credits are, how they are being used, and what the future might look like for these climate trading pieces.

Why Do We Care About CO₂?

Carbon dioxide (CO₂) is a greenhouse gas (GHG). As these gasses become more concentrated in the atmosphere, they trap heat from the sun that would otherwise escape into space—contributing to the warming of the earth. This is a natural process known as the greenhouse effect.

Many of these gasses are naturally occurring, however, human-generated pollution has accelerated the amount of gasses trapped in the atmosphere. The enhanced greenhouse effect leads to an increase in the Earth’s average surface temperature, known as global warming.

The warming of the Earth’s surface has widespread impacts on climate patterns, weather events, and ecosystems. These combined effects are referred to as climate change.

While there are other gasses that contribute to the greenhouse effect, CO₂ is the largest contributor. According to the EPA, the Total U.S. Emissions in 2021 were equivalent to 6,340 Million Metric Tons of CO₂ (excludes land sector). Other GHGs that contribute to the greenhouse effect include:

Methane (CH4)

Nitrous oxide (N2O)

Hydrofluorocarbons (HFCs)

Perfluorocarbons (PFCs)

Sulfur hexafluoride (SF6)

Nitrogen trifluoride (NF3)

What are Carbon Credits?

With growing recognition of the impact of GHG on the climate and environment, we’ve seen increased efforts to control and mitigate emissions. Those regulations created a new economy around climate technology and emissions mitigation. Enter carbon credits.

A carbon credit represents one ton (or tonne) of CO₂ that an organization is permitted to emit. The exact definition varies depending on your source—and their motivations. For example, you can compare these two definitions:

Choose.today says that carbon credits, “allow companies, governments, and other organizations to address their greenhouse gas emissions by funding projects that reduce or remove carbon dioxide or other harmful GHG emissions from the atmosphere.” Going further, they add, “the goal of carbon

credits is to create a financial incentive for businesses to reduce their carbon footprint and invest in cleaner, more sustainable business practices.”Meanwhile, Investopedia defines carbon credits as “permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gasses.” This definition emphasizes that carbon credits can be used as “get out of jail free cards,” allowing companies to emit carbon without risk of penalty as long as they can fit the bill.

Carbon Credits vs Carbon Offsets

While “carbon credits” and “carbon offsets” are often used interchangeably, there is a distinct nuance between the two. Carbon credit is the more general term that encompasses various types of tradable units representing emissions reductions.

Carbon offsets, on the other hand, are a type of carbon credit. Typically carbon offsets refer to projects that are conducted somewhere else, which the buyer is helping fund, while keeping their own emissions the same or using other reduction methods.

Types of Carbon Credits

Carbon offsets are just one of many types of carbon credits, each representing a different approach to reducing or offsetting GHG emissions. These credits are often categorized based on the type of project or activity that generates them.

Here are a few common types of carbon credits and their definition:

Energy Efficiency Credits: These credits reward energy-saving initiatives in buildings, transportation, and industrial processes.

Renewable Energy Credits (RECs): These represent the environmental benefits of generating clean energy, such as wind or solar power.

Agricultural and Forestry Credits: These offset emissions by promoting sustainable farming and forestry practices that sequester carbon.

Industrial and Process Credits: These support emission reduction efforts in manufacturing and other industrial processes.

Transportation Credits: These offset emissions from transportation-related activities, like fuel-efficient vehicle projects.

Methane Reduction Credits: These credits focus on mitigating methane emissions, often from landfills or livestock operations.

Examining Carbon Credit Costs and Value

Like many of today’s hot new currencies—think crypto and NFTs—the lack of standardization about how to evaluate the value of carbon credits has created a gold-rush style, wild-west scenario. For example, some businesses are purchasing carbon credits for a whole year or multiple years, buying up credits for offsets that haven’t yet been produced. And without clear standards for value analysis, this market has a name-your-own-price system based on self-described claims of esoteric climate value.

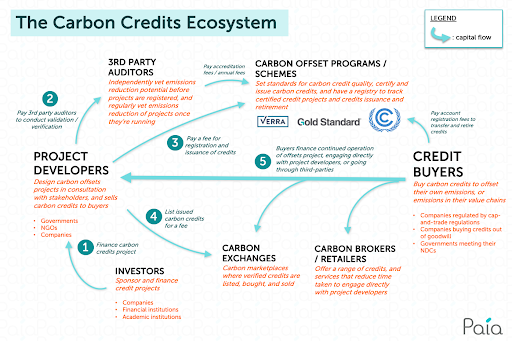

Putting a price on emissions is a big undertaking, but that’s exactly what some folks are trying to do. The ecosystem around carbon credits is expanding and growing ever-more complex. As more vendors enter the market, the process of value verification and standardization is becoming more prevalent.

Here are some of the controls entering the market:

Third-Party Auditors independently vet emissions reduction potential before projects are registered, and regularly vet emissions reduction of projects once they are running.

Carbon Offset Programs / Schemes set standards for carbon credit quality, certify and issue carbon credits, and have a registry to track certified credit projects.

Carbon Brokers / Retailers offer a range of credits and services that reduce time taken to directly engage with project developers—those designing carbon offset projects.

Carbon Exchanges establish marketplaces where verified credits are listed, bought, and sold.

Each new contributor that steps between the project developers and the credit buyers adds an additional layer of cost. However, these ecosystem contributors play an important role, providing assurances that help verify the true value of the carbon credit—both to the buyer and the environment.

Pros and Cons of Carbon Credits

There are a number of criticisms about the effectiveness of carbon credits—largest among them being the question of if we are just giving corporations a free pass to create more emissions by letting them buy their way out of the climate crisis?

Many activists counter that we can’t gain climate buy-in by shutting down the world. Take for example the airline industry. Shutting down all air traffic isn’t a viable option in a globally-distributed, interconnected world. That said, the corporations responsible for these emissions can be regulated to purchase credits that offset excess while actively pursuing and implementing more sustainable solutions.

Another argument against offsets is the value. Specifically, there have been a number of scandals around agricultural and forestry credits. The repeated misuse of carbon credits has resulted in a number of arguments. For example, an article by ProPublica points to reasons why forest offsets can actually be worse than doing nothing.

For many in the space, the hope is that the new stopgaps and verification systems in the carbon credits ecosystem will act as a quality control, ensuring the available credits provide a measurable, positive impact on the environment. For companies investing in carbon capture and climate tech (the project developers from Paia ecosystem chart above), these credits can create additional revenue streams to help fund future investments in innovation.

Are Carbon Credits a Part of a More Sustainable Solution for All?

Negative emissions are required in order to reach goals of a net-zero emissions by 2050. The carbon credit market is meant to help fund innovative climate solutions so they can continue to remove CO₂ from the air.

At Carbon Reform, creating safe and equitable human health and air quality is central to our mission. We believe that carbon credits can be a valuable tool towards climate action, but only if used responsibly.

We’re also analyzing where and if at-home or in-office carbon capture falls into this landscape. When compared to other types of carbon credits, Carbon Reform’s technology solutions remove carbon much more directly than most offset programs. For example: we’re not investing in eco-friendly farming practices that may impact levels of carbon production, we’re actually removing carbon from the air. Perhaps we need a new category?

In the meantime, we’re continuing to monitor the evolution of carbon credit design, verification and regulation. We invite you to learn about Carbon Reform’s innovative climate technology, and find ways to get involved with our work!